6

2015 Year in Review

Commercial Aerospace Outlook

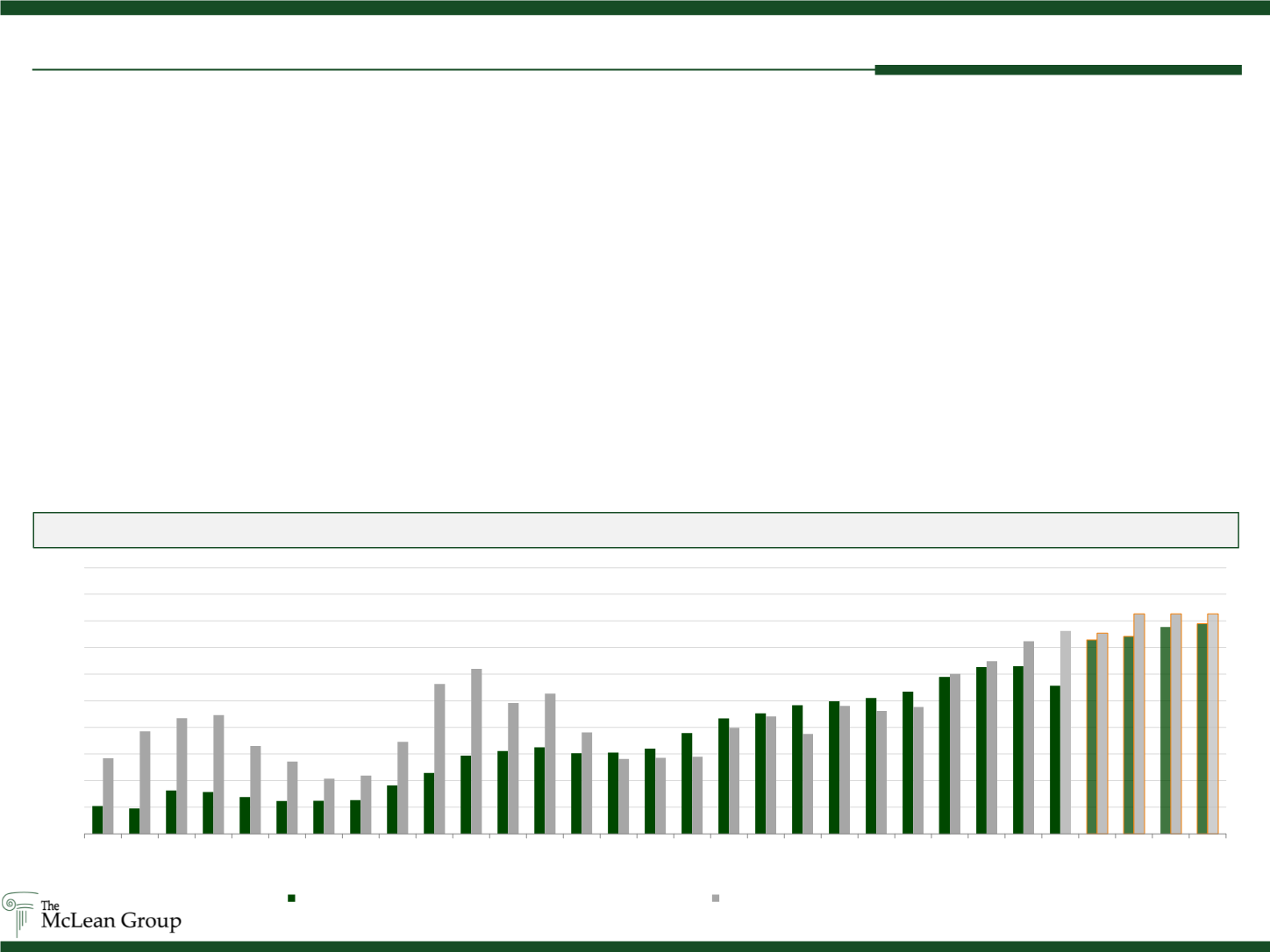

Source: Open Sources, Boeing and Airbus Public Filings, Fairmont Consulting Group Analysis, Ascend Flight Global

OEMs have seen record levels of new aircraft orders over the last several years. These orders have been buoyed by an increase in

global demand for air travel, the introduction of more fuel-efficient aircraft, and historically low-interest rates. Through the first eleven

months of 2015, Airbus posted 1,007 net orders outpacing Boeing’s 768 full year net orders. However, Boeing remained king when it

came to aircraft deliveries, delivering a record 762 planes in 2015 while Airbus delivered 556 through November 30. On December 31,

Boeing's backlog of orders stood at 5,795, representing more than seven and a half years of production at the current rate. While Airbus

had an industry record backlog of 6,837, as of November 30. Boeing and Airbus will need to continue to ramp up production to fill this

record level of backlog. Constituents of their supply chains also will need to match the increased demand. This could mean that

members of the supply chain will be on the look out for tuck-in acquisitions to increase production.

As 2016 begins, the commercial airspace industry faces many headwinds. Over the last year, China’s economy displayed signs of

weakness, oil prices have dropped precipitously, and the US Federal Reserve raised interest rates for the first time since 2006. Boeing

forecasts that by 2020 half of the world’s airline fleet will be leased. As leasing becomes more common and a greater percentage of overall

aircraft orders, cost of capital will become an increasing concern in the industry. If interest rates rise too much, leasing companies may need

to cancel orders as their business models no longer remain viable. This could have a significant impact on an industry predicated on long-

term backlogs. While investment in next generation aircraft likely will not cease, there remain many hurdles to overcome.

Airbus and Boeing Aircraft Deliveries and Production Plans

0

100

200

300

400

500

600

700

800

900

1000

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Airbus Deliveries / Production Plans

Boeing Deliveries / Production Plans