17

2014 Year in Review

Dry Powder Calculations

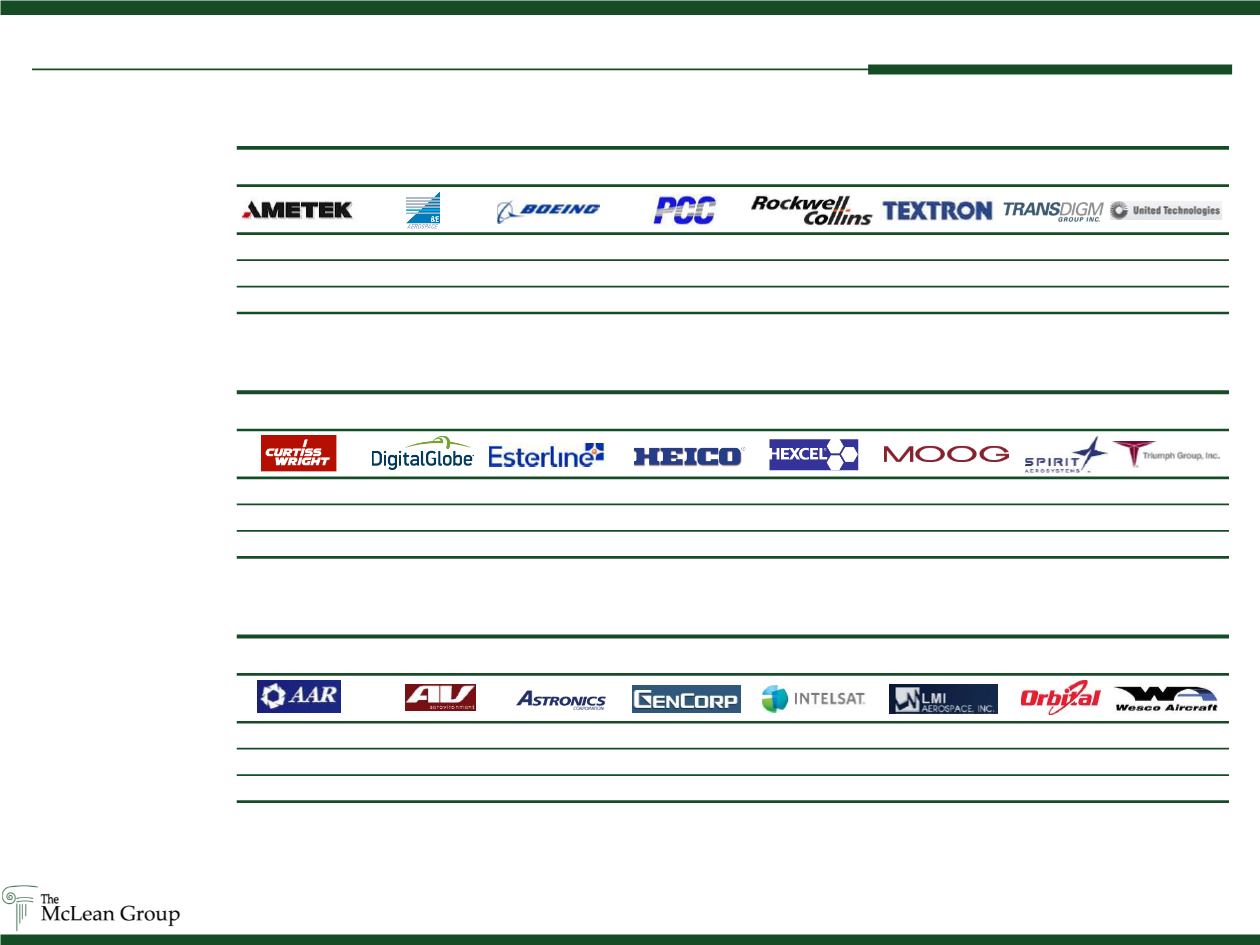

(Aerospace)

Mid Cap Aerospace Index

3x LTM EBITDA

$1,198.0

$915.6

$1,103.3

$798.4

$1,131.0

$1,062.5

$1,347.9

$1,290.2

Less LT Debt

959.0

1,138.9

622.5

329.1

416.3

951.6

1,156.6

1,442.7

Plus Cash

222.5

127.4

238.1

20.2

70.9

240.2

452.8

34.2

Dry Powder

$461.5

($95.9)

$719.0

$489.6

$785.6

$351.2

$644.1

($118.3)

Small Cap Aerospace Index

3x LTM EBITDA

$610.8

$46.4

$378.2

$424.5

$5,917.6

$129.3

$462.0

$616.0

Less LT Debt

635.3

0.0

212.6

782.2

15,454.0

272.7

136.9

1,106.8

Plus Cash

92.6

126.3

24.9

265.9

656.0

2.5

427.5

104.8

Dry Powder

$68.1

$172.7

$190.5

($91.8)

($8,880.4)

($140.9)

$752.7

($386.1)

Large Cap Aerospace Index

3x LTM EBITDA

$3,107.0

$1,573.2

$27,306.0

$9,456.0

$3,477.0

$4,725.0

$3,215.1

$35,028.0

Less LT Debt

1,714.0

2,429.7

9,070.0

4,320.0

2,501.0

4,116.0

7,515.3

19,794.0

Plus Cash

377.6

292.5

11,733.0

0.0

315.0

731.0

1,011.6

5,235.0

Dry Powder

$1,770.5

($564.0)

$29,969.0

$5,136.0

$1,291.0

$1,340.0 ($3,288.6)

$20,469.0

($ millions)

Source: Public Filings; Capital IQ as of 1/30/15