9

2014 Year in Review

Commercial Aerospace Outlook

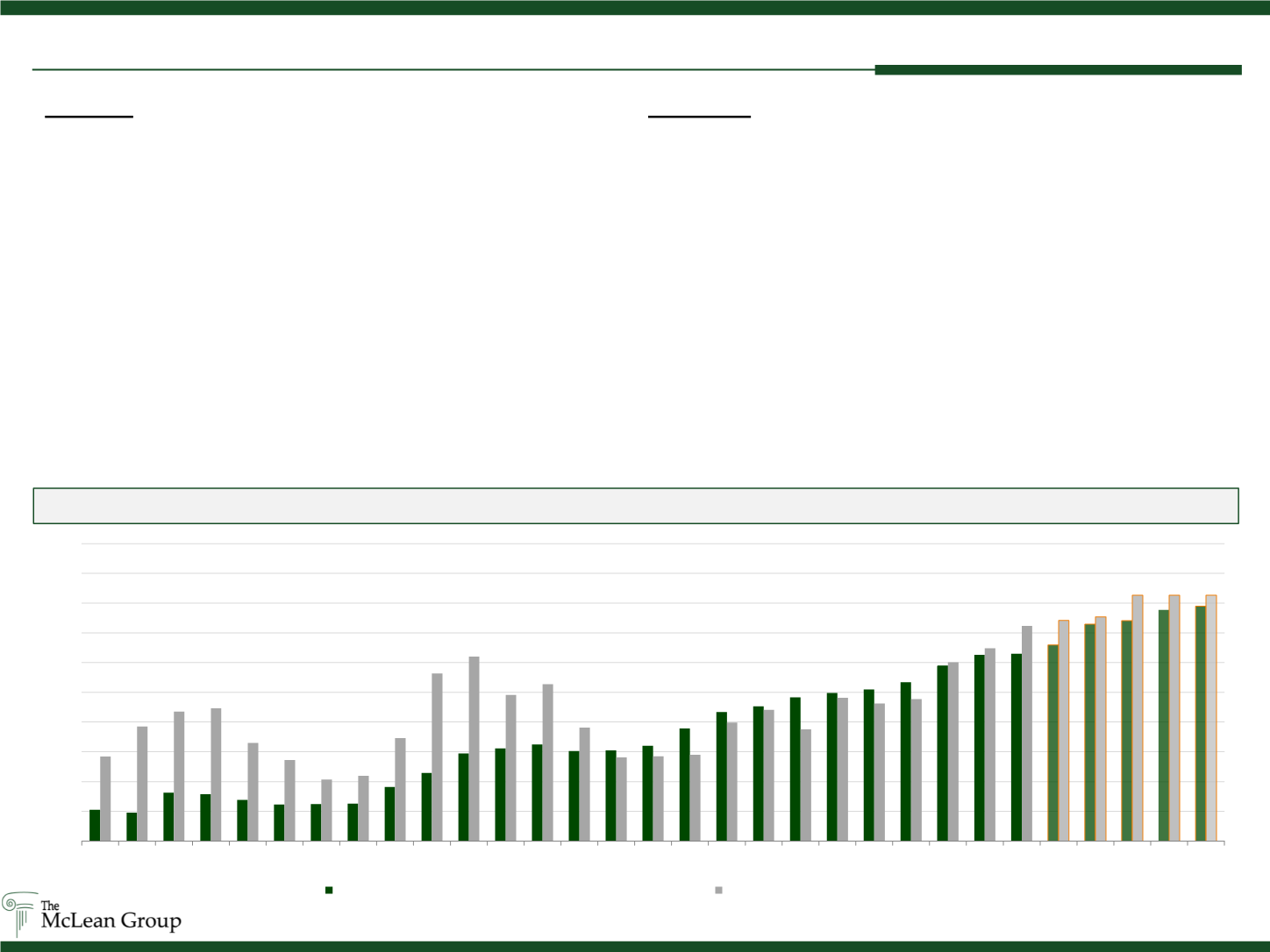

Source: Open Sources, Boeing and Airbus Public Filings, Fairmont Consulting Group Analysis, Ascend Flight Global

Tailwinds:

2014 was a another record year for both Boeing and

Airbus with their combined backlogs growing 14% from 10,639 in

2013 to 12,175 at the close of 2014. Boeing once again retained its

status as world’s top planemaker, delivering 723 aircraft while

Airbus delivered 629. New orders continue to be driven primarily by

a growing global middle class, especially in the Asia-Pacific, and

new fuel-efficient aircraft options. Air travel demand remained

resilient despite the most recent Ebola outbreak, terrorist threats

and wars in the Middle East and Ukraine. Boeing forecasts

passenger traffic will grow more than 160% by 2033, at a

compound annual growth rate (CAGR) of 4.7%. Demand from

China is projected to pass the US market by 2030 helping to set

this cycle apart from previous cycles that were largely dominated

by orders from the US and Europe.

Airbus and Boeing Aircraft Deliveries and Production Plans

Headwinds:

One of the major issues is whether or not suppliers

can continue to keep pace and make the necessary investments to

support this unprecedented upcycle. With more than $1 trillion in

backlog, delivery rates are a key topic for suppliers and a driving

factor behind supply chain consolidation. As suppliers are adjusting

to meet OEM demand, the high fuel prices that helped boost

backlogs over last four years fell by 50% in Q4. This price swing is

driving up the value of aircraft in service at a time of rising near-

term demand and putting downward pressure on the premium

prices demanded by the newest Airbus and Boeing aircraft. If fuel

prices remain at current levels for a prolonged period, the current

production plans could be disrupted as fuel comprises roughly 30%

of airline costs. While investments in new-technology aircraft are

unlikely to stop, the pace and rationale will likely be affected.

0

100

200

300

400

500

600

700

800

900

1000

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Airbus Deliveries / Production Plans

Boeing Deliveries / Production Plans