7

2014 Year in Review

2014 Aerospace M&A Trends

Source: InfoBase; Capital IQ as of 12/31/13

Acquisition Activity by Buyer Type

Buyer

Target

EV

Coast Plating

NA

Chrome Plus International

NA

Coastline Metal Finishing

NA

Dynamic Paint Solutions

NA

Pride Plating

NA

Blue Streak Finishers

NA

Sungear, Inc.

NA

Crown Precision Machining

NA

Furth Rixson

$2,900.0M

SOS Metals, Inc.

NA

Trans World Alloys Company

NA

Aerospace Dynamics Intl.

$625.0M

Teseq Group

$91.8M

Amptek

NA

VTI Instruments

$74.0M

Pacific Precision Products

NA

Greenpoint Technologies

NA

Enviro Systems

NA

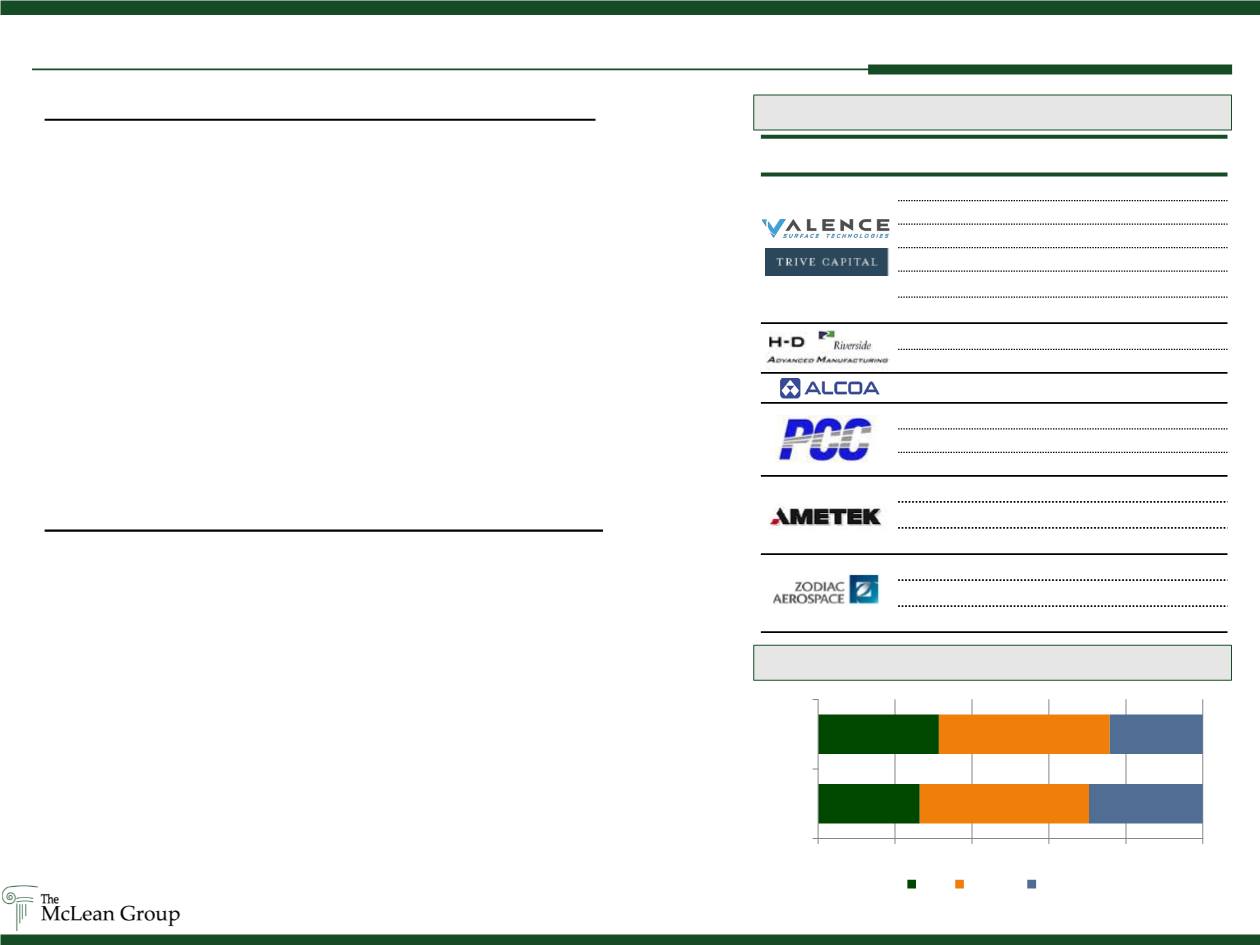

Downstream Roll-up / Consolidation of Niche Capabilities

Both Strategic and Financial buyers invested in significant consolidation

opportunities throughout 2014, most notably marked by a downstream focus.

Trive Capital was the most active, rolling up six aerospace metal finishing

companies under newly formed Valence Surface Technologies. Riverside

Capital’s H-D Manufacturing acquired well-known gear specialist, Sungear as

well as Crown Precision Machining. Zodiac made three acquisitions, growing

capabilities in aircraft interior systems. AMETEK also made three acquisitions,

advancing positions in precision testing equipment. Precision Castparts’

appetite for acquisitions carried through into 2014 with three acquisitions in

machining, metal products distribution and metal waste treatment. Finally light-

weight metal giant, Alcoa acquired Furth Rixson in a $2.9 billion transaction

that positions Alcoa as the global leader in seamless rolled jet engine rings.

Spotlight on Continued Growth of Private Equity Presence

PE Groups continued to expand their Aerospace positions in 2014, comprising

nearly a third of all acquisitions and representing only 17% of sellers. A strong

commercial aircraft backlog, growing global air traffic forecasts as well as

expanding demand and advances in the space and satellite sectors continued

to attract PE buyers despite high valuation multiples. In addition to the notable

2014 roll-up efforts by Riverside and Trive Capital, several other firms began

building or expanding aerospace positions. Arlington Capital’s MB Aerospace

acquired Norbert Industries in Q2, adding engine expertise to its portfolio. RFE

Investment partners acquired PCX Aerostructures from SPX Corp in Q2 and

followed it quickly with the acquisition of Cam-Tech Manufacturing in Q4.

Additionally, Veritas acquired EMCORE’s Space Photovoltaics business and

Warburg Pincus acquired Wencor Group from Odyssey Investment Partners.

Notable Roll-up / Consolidation Activity

26%

31%

44%

44%

30%

24%

0% 20% 40% 60% 80% 100%

2013

2014

PE Public Private