8

2014 Year in Review

2014 was an exciting year for the Space and Satellite sector marked by expanding competition,

ambitious investments and headline successes – among the most notable of which was the

successful landing of the Rosetta Mission’s Philae Probe on a comet.

Launch Sector Competition:

Although the launch sector has experienced few significant

technological changes as of late, the federal funding mechanisms are rapidly evolving. Since

governments typically sponsor two-thirds or more of annual launches, this is quickly reshaping

the competitive landscape. Launch contracts are shifting from traditional government

contracting vehicles to less stringent contracts allowing contractors greater discretion in

exchange for cost reductions. This shift has made room for commercial players such as

SpaceX to grab market share from Boeing and Lockheed’s United Launch Alliance (ULA), the

long-dominant industry prime. SpaceX has already completed 14 successful launches, won a

$1.6 billion NASA contract to resupply the International Space Station and captured a $2.6

billion contract to design the next-generation NASA transport system. Additionally, SpaceX is

now protesting the Air Force $11.0 Billion Evolved Expendable Launch Vehicle award to ULA

and most recently received a $1.0 billion investment from Google. The shifting contracting

landscape is part of the strategic rationale behind the planned $5.0 billion Orbital Sciences and

ATK Aerospace and Defense Group merger. The deal has progressed despite an October

launch failure as the two companies look to leverage their combined reputations and

capabilities to capitalize on the evolving marketplace and opportunities for innovation.

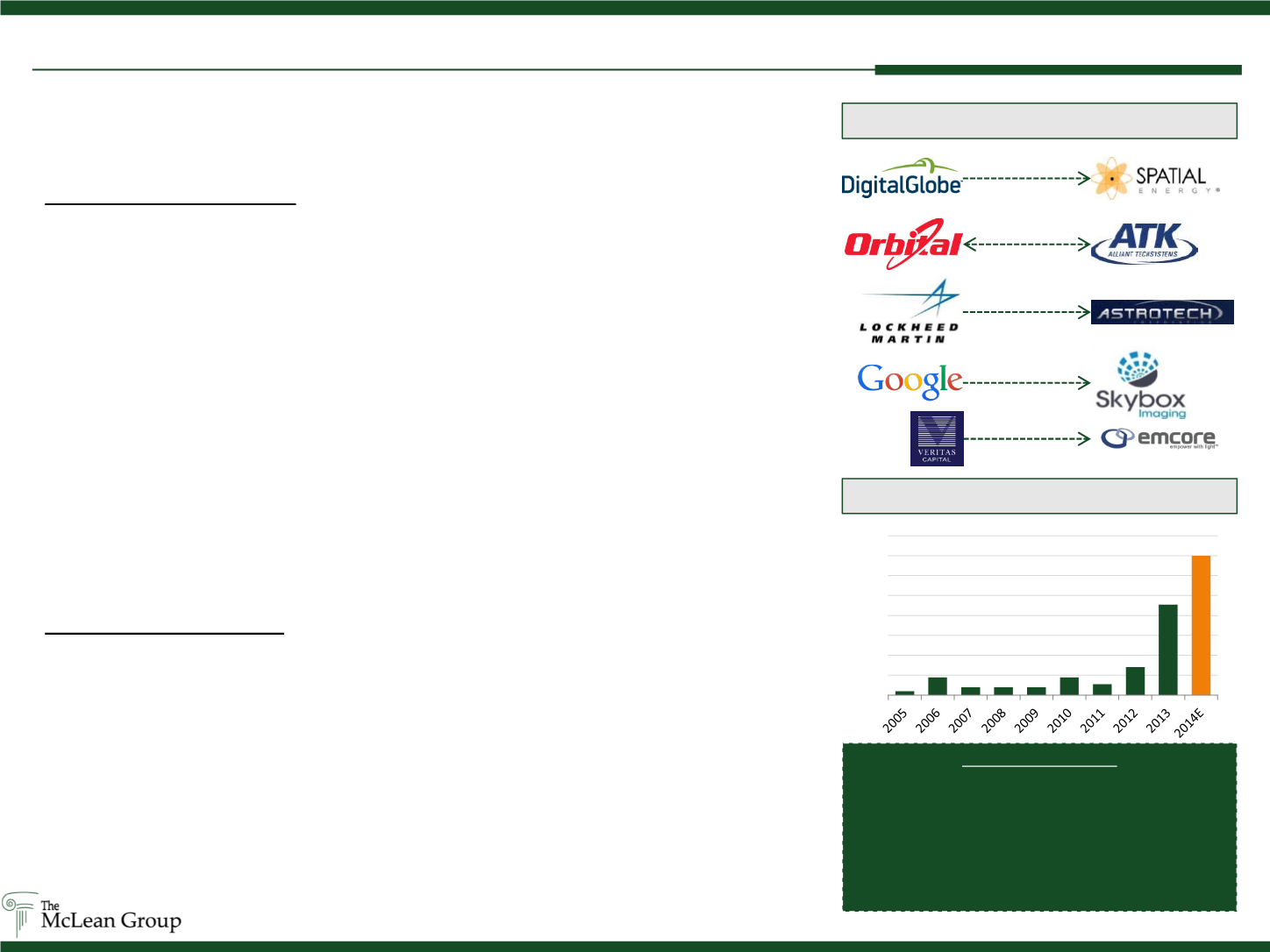

Satellite Market Disruptors:

Innovations in satellite technology and rapidly growing demand

from TV and Internet providers are helping fuel commercial launch demand. However, Google’s

foray into the satellite market via its $500 million purchase of Skybox presents several areas of

potential market disruption. Google’s model of adding internet users to drive advertising

revenue is an interesting challenge to traditional satellite revenue streams based on fee for

service. Additionally, existing fixed cost models are being impacted by satellite size reductions

through Cubesat design and other innovations. Skybox satellites are 20x smaller, 10x cheaper

than traditional satellites and visual acuity is generated from its software rather than optics.

Further, frameworks are increasingly based on open source technologies. These innovations

are lowering costs by allowing multiple satellites a single launch vehicle and limiting

maintenance and upgrades, creating new opportunities for both consumers and suppliers.

Market Evolution in Space and Satellite

Source: Open Sources, Public Filings, “Sate of the Satellite Industry Report 2014” The Tauri Group

Notable Space & Satellite Acquisitions

Aerospace & Defense

Cubesat Launches

91

140

0

20

40

60

80

100

120

140

160

Cubesat Unit Cost Scale

Low Cost:

1U cubesat bus kits $13,000, with 6U

configurations reaching $30,000

Moderate Cost:

Boeing-built cubesat platforms for

NRO are estimated at $250,000

Higher Cost:

NASA estimates cubesats used for

planetary science missions at $3-$10 million

Space Operations

Space Photovoltaics

acquired

acquired

will merge

acquired

acquired