2

2014 Year in Review

35 36

39

43

37

29

31

28

40

28

32

29

Q4

2014

Q3

2014

Q2

2014

Q1

2014

Q4

2013

Q3

2013

Q2

2013

Q1

2013

Q4

2012

Q3

2012

Q2

2012

Q1

2012

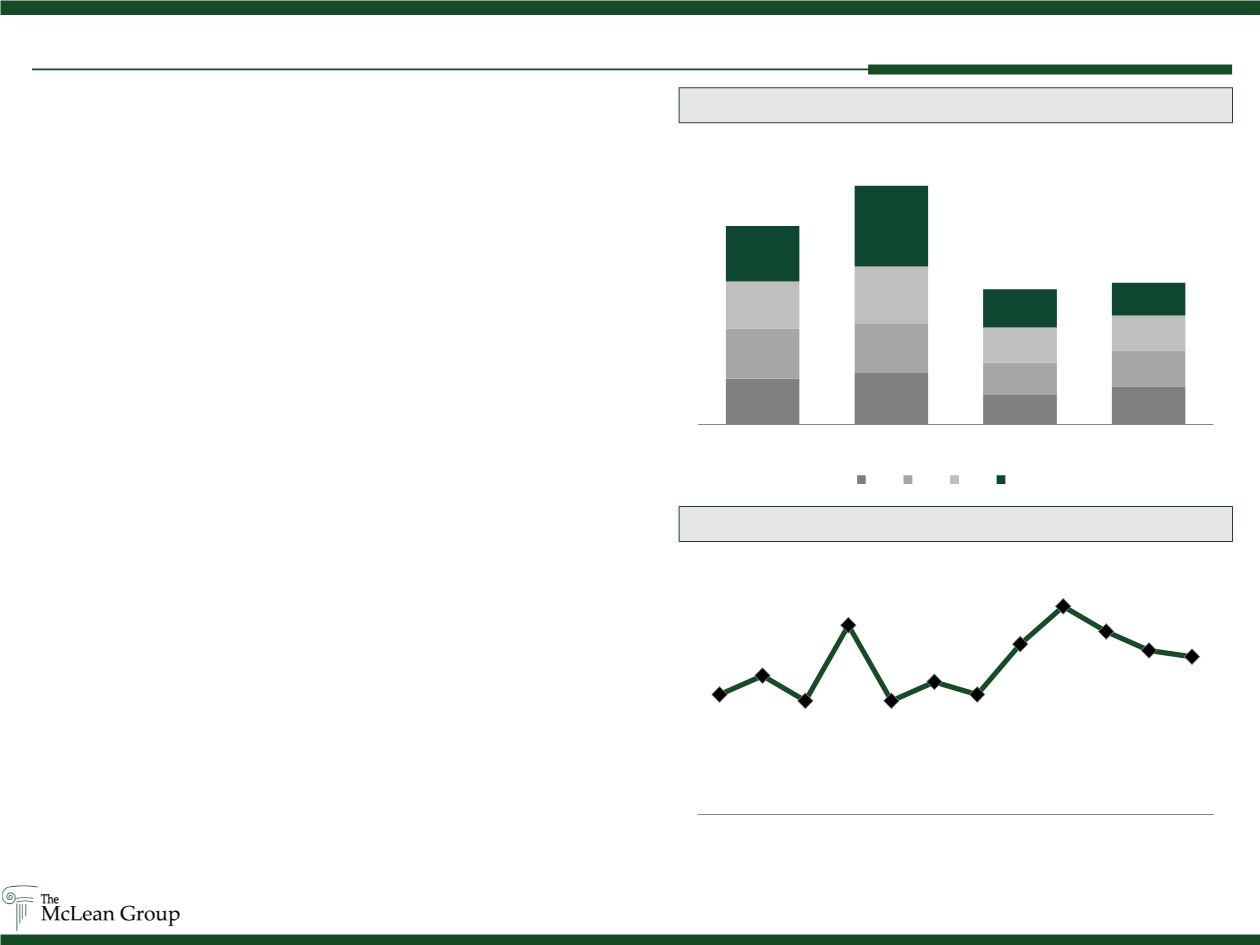

2014 ADG M&A Overview

Source: InfoBase; Capital IQ as of 12/31/14

Quarterly Aerospace Transaction Activity

TMG recorded 30 announced Defense and Government Services

transactions and 35 announced Aerospace transactions during Q4.

During 2014, TMG recorded 130 transactions in the Defense and

Government Services sectors, a modest increase from 2013. However,

the return of public company buyers has improved the overall M&A

market, driving competition and improving valuations. In 2014, large

transactions – those greater than $200 million – accounted for a far

greater number of transactions than in 2013. The SI Org, now

rebranded as Vencore, acquired QinetiQ N.A.’s services division;

Raytheon acquired Blackbird Technologies, and BAE Systems acquired

SilverSky to name a few. In the greater than $1.0 billion category,

AECOM acquired URS, Cobham acquired Aeroflex, and Engility will

acquire TASC. Q4 2014 activity was down compared to prior years,

which could indicate that Q1 2015 may see increased activity as a

result of spillover from deals that were not completed prior to year-end.

North American based aerospace acquisition activity increased by 22%

from 125 announced transactions in 2013 to 153 in 2014. Growth was

fueled by PE backed purchases which expanded nearly 50%, and

represented 31% of all transaction activity, up from 26% in 2013.

Acquisitions by public companies grew by 24% while private buyer

activity remained at 2013 levels. Reported multiples in 2014 remained

steady with average reported EV/EBITDA and EV/Revenue multiples of

10.0x and 2.2x, respectively. Of the transactions with reported

enterprise valuations, 17 were in excess of $100.0 million, three of

which were in excess of $1.0 billion. Valance Surface Technologies

(Trive Capital) was the most active buyer with five acquisitions, while

AMETEK, Lockheed Martin, Precision Castparts, and Zodiac

Aerospace each made three acquisitions. TMG tracked 32 announced

divestitures in 2014, or 21% of all transactions, which was consistent

with 2013 levels.

Defense and Government Services Transaction Activity

42

48

28

35

46

45

29

33

43

52

32

32

51

74

35

30

2011

2012

2013

2014

Q1 Q2 Q3 Q4

182

219

124

130