1

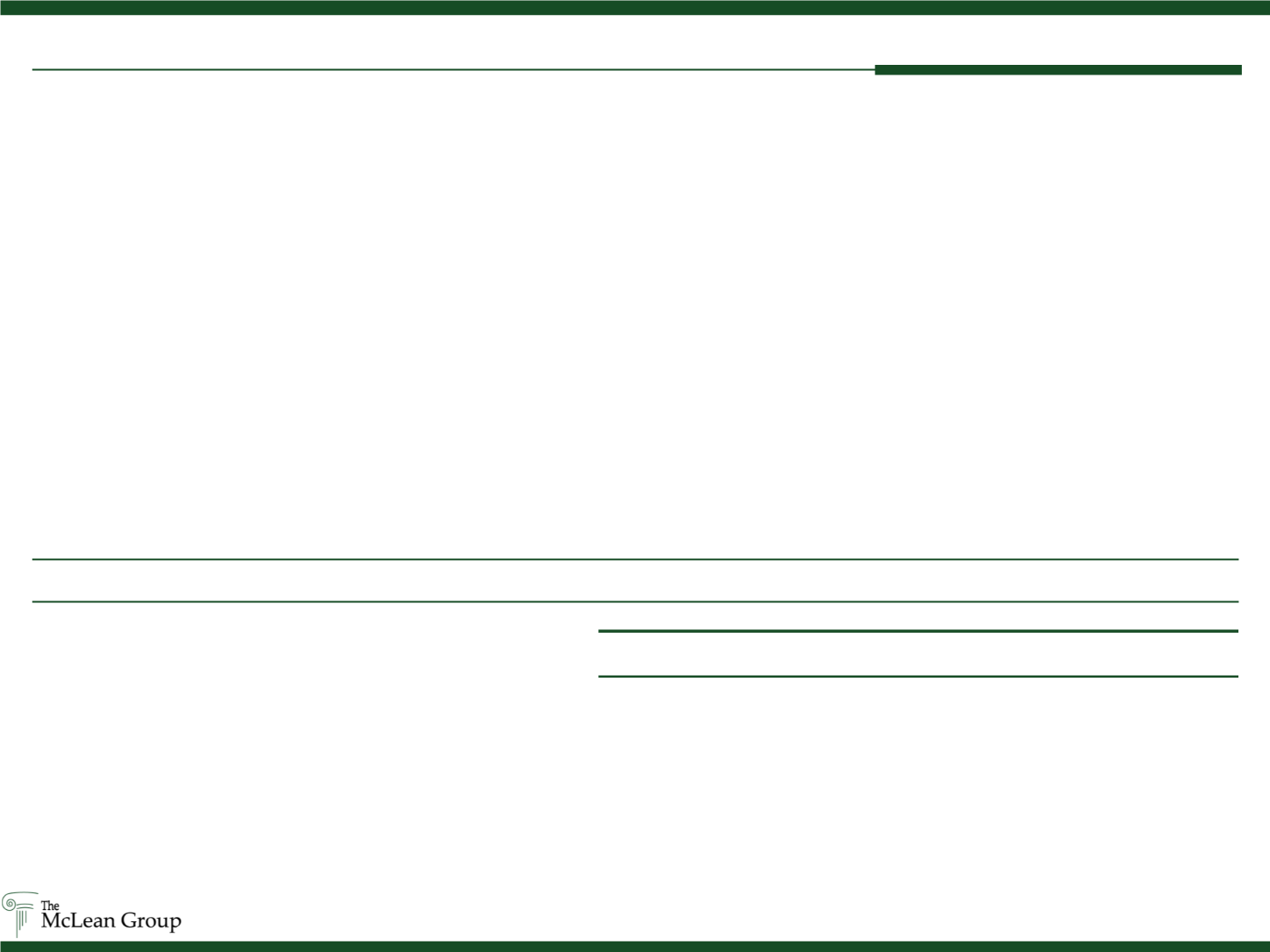

2014 Year in Review

% Change

First Half

2014

Second Half

2014

CY2014

Defense Prime Index

2.5% 12.7% 15.5%

Defense Systems Index

7.4%

(0.9%)

6.5%

Diversified Government Services Index

1.3% 16.5% 18.0%

Middle Market Government Services Index

6.6% 7.2% 14.2%

Large Cap Aerospace Index

(0.0%)

(2.0%)

(2.1%)

Mid Cap Aerospace Index

7.7%

(4.7%)

2.7%

Small Cap Aerospace Index

(8.6%)

(0.2%)

(8.8%)

International Aerospace Index

(16.6%)

(9.1%)

(24.2%)

S&P 500

5.0% 6.1% 11.4%

Notable 2014 M&A Activity

Capital Markets

Orbital Sciences and ATK Aerospace & Defense announced a

$5.0 billion merger

AECOM acquired URS Corp for $6.0 billion

Google acquired Skybox Imaging for $500.0 million

Warburg Pincus acquired Wencor Group from Odyssey

Investment Partners

Engility will acquire TASC from KKR and General Atlantic for $1.1

billion

Alcoa acquired Firth Rixson for $2.9 billion

Raytheon acquired Blackbird Technologies for $420.0 million

Executive Summary

Source: Public Filings; Capital IQ as of 12/31/14

The US economy grew modestly in 2014 with the S&P up 11.4% for the year. The Defense and Government service sector’s performance

was in line with the rest of the market. Meanwhile the Aerospace sector underperformed due to concerns that the current aerospace cycle

may be reaching its peak despite another record setting year for Airbus and Boeing in both backlog and deliveries.

Defense and Government Services’ 2014 transaction volume was stable but showed promising signs of growth with the notable increase

in public buyer activity. The share of total transactions by public buyers in the space grew from 29% in 2013 to 48% in 2014. Public

company investment increases coincided with definitive actions by Congress which included passing a $1.1 trillion budget funding the

federal government through the current fiscal year and a defense authorization bill setting clear defense spending priorities. Industry

players are confident the full consequences of sequestration have been realized and investor confidence is returning in part due to

increasingly stable funding and strategy. Additionally, in 2014 the rapid expansion of ISIS from Syria into Iraq and escalating Russian

aggression in Eastern Ukraine as well as the largest Ebola outbreak to-date, presented new challenges for the US government. The

ongoing light footprint response is creating new opportunities for companies able to contribute to a more agile, responsive and

technologically superior military force capable of quickly reacting to world events.

Aerospace transaction activity increased 22% during 2014 as suppliers continue to consolidate to meet OEMs’ record level production

plans. Driven by rapidly growing commercial demand in Asia Pacific, this aerospace cycle continues to differentiate itself from previous

cycles helping to sustain growth and high transaction multiples. Supplier consolidation is not only being driven by large strategic

suppliers, but Private Equity as well. Supported by low interest rates and strong OEM aircraft backlogs, PE presence continued to

increase in 2014, acquiring companies in niche capability sectors and comprising nearly a third the total Aerospace 2014 M&A activity.