2

First Quarter 2015

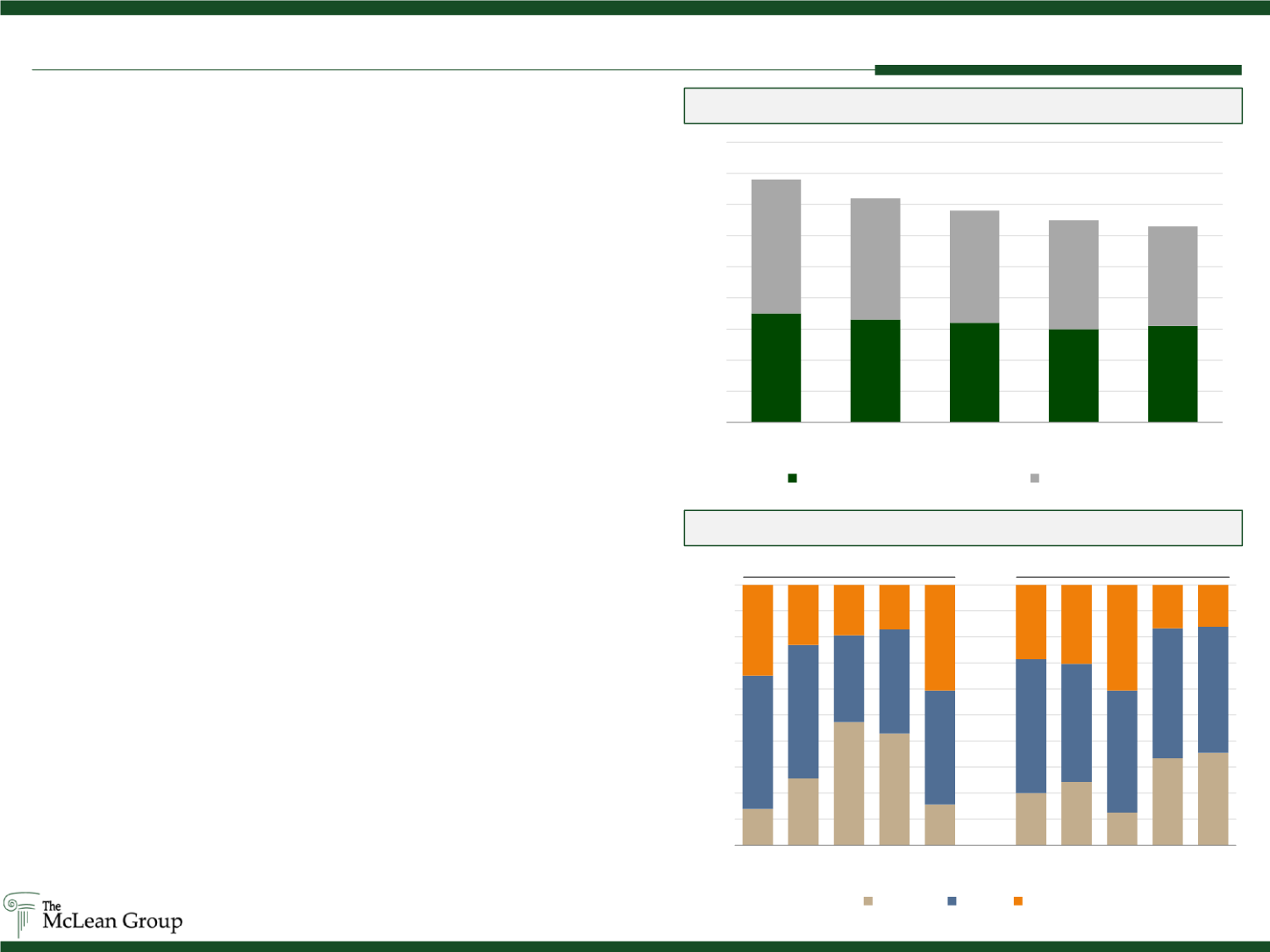

Quarterly Transactions by Buyer Type

M&A Analysis

The McLean Group tracked 31 announced Defense and Government

Services sector transactions during Q1 2015. This is up from Q4 2014 but

slightly down from Q1 2014 which tracked 35 announced transactions. The

trend of increased public buyer activity has continued throughout Q1 with

public companies representing the most active buyer, accounting for 48%

of acquisitions YTD. Private companies receded as buyers, accounting for

only 16% of the acquisitions whereas private equity has significantly

increased activity, accounting for 35% of acquisitions up from 22% over the

previous year. Notable transactions in Q1 2015 include: Harris’ announced

acquisition of Aerospace & Defense systems provider Exelis for $4.8 billion;

SAIC’s announced purchase of Intelligence Community solutions provider

Scitor from Leonard Green Partners for $790.0 million; and MAXIMUS’

acquisition of Healthcare IT solutions provider Acentia from Snow Phipps

Group for $300.8 million.

Announced North American Aerospace M&A activity in Q1 continued a

gradual decline from the three year quarterly high in Q1 2014, but was

consistent with the three year quarterly average. Public buyers remained

the most active acquirers, representing nearly half of Q1 buyers. Alcoa

continued its acquisition streak, following its 2014 purchases of Firth

Rixon and TITAL GmbH with the $1.8 billion acquisition of RTI

International Metals. HEICO made dual purchases in Q1, acquiring

Aeroworks International Holdings and Harter Industries. TransDigm, RBC

Bearings and Onex Corp all made significant acquisitions valued at $500

million or larger. PE backed acquisitions shrank to just 16% of quarterly

activity, down from 31% in 2014. Meanwhile private buyers increased

their presence from 24% of buyers in 2014 to 41% in Q1 2015. Notable

private buyers in Q1 included Sierra Nevada Corp., STS Aviation Group

and StandardAero. Divestiture activity increased, comprising 38% of Q1

transactions, up from 22% and 21% in 2013 and 2014 respectively.

Bombardier, GE Aerospace, AAR Corp, UTC, Curtis-Wright, Rockwell

Collins and L-3 all had meaningful aerospace divestitures.

Recent Transaction Activity by Quarter

Source: InfoBase; Capital IQ as of 3/31/15

35

33

32

30

31

43

39

36

35

32

78

72

68

65

63

0

10

20

30

40

50

60

70

80

90

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Defense & Government Services

Aerospace

14%

26%

47% 43%

16%

20% 24%

13%

33% 35%

51%

51%

33% 40%

44%

51% 45%

47%

50% 48%

35%

23% 19% 17%

41%

29% 30%

41%

17% 16%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15

Financial

Public Private

Aerospace

Defense & Gov. Services