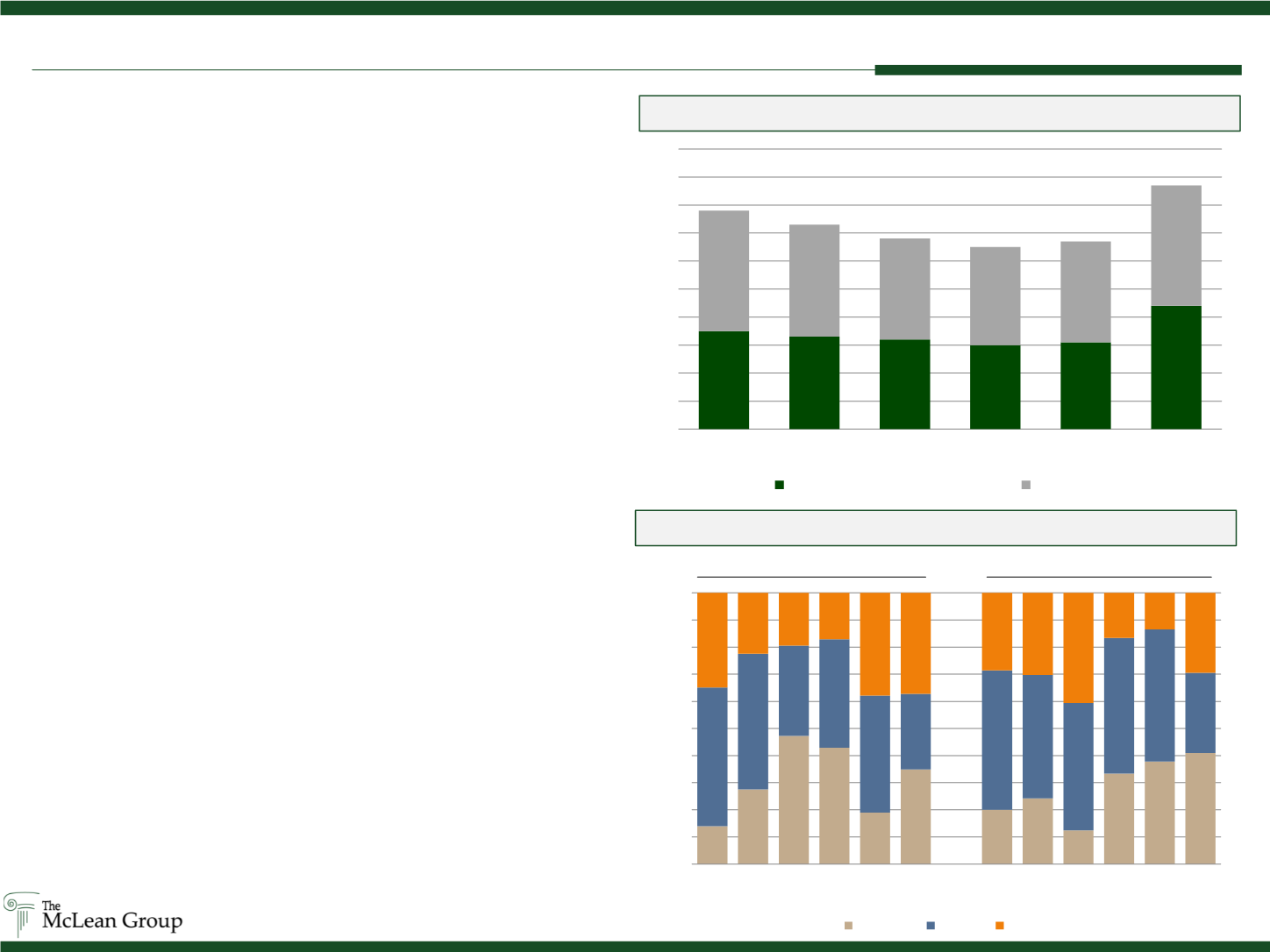

2

Second Quarter 2015

35

33

32

30

31

44

43

40

36

35

36

43

0

10

20

30

40

50

60

70

80

90

100

Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

Defense & Government Services

Aerospace

M&A Analysis

Source: InfoBase; Capital IQ as of 3/31/15

Quarterly Transactions by Buyer Type

Recent Transaction Activity by Quarter

Aerospace

Defense & Gov. Services

78

73

68

65

67

87

The Mclean Group tracked 44 announced Defense and Government

Services sector transactions during Q2 2015. The public buyer

presence, which was evident over the past five quarters, diminished

slightly in Q2 as buyers digested recent purchases and shaped

portfolios. CSC announced that it will split into two companies

targeting global commercial markets and the US public sector.

Several other key companies announced divestures including

ManTech, Kratos and General Dynamics. Private equity companies

represented the most active buyer category, accounting for 40% of the

quarter’s acquisitions, the largest of which was Charterhouse Capital

Partners’ purchase of Mirion Technologies for $750 million. Other PE

backed activity included The Constellis Group’s purchase of The Olive

Group and Marlin Equity’s dual purchases of Fidelis Cybersecurity

(from General Dynamics) and Resolution1 Security. Lindsey Goldberg

announced an equity steak in ECS Federal which announced two

acquisitions in Q2. Meanwhile the PE group's other platform, PAE,

purchased A-T Solutions.

North American Aerospace M&A activity continued to increase during

Q2, reaching 43 announced transactions. Private buyers were the

most active acquirers in Q2 by volume representing approximately

37% of the buyer pool. Although decreasing as a percent of total

transactions, public buyers’ M&A activity remained steady, and was

led by several notable acquisitions of PE portfolio companies

including TransDigm’s purchase of Pexco from Odyssey Investment

Partners for $336 million and L-3’s purchase of CTC Aviation Group

from Inflection Point Partners. While some PE groups exited, many

more continued to build their aerospace portfolios. Carlyle Group

backed Landmark Aviation continued its acquisition streak purchasing

both ERA FBO and TWC Aviation in April, marking a total of six

acquisitions in the past year. Riverside Company’s H-D Advanced

Manufacturing Company also made two new purchases while Veritas

Capital acquired yet another aerospace platform, acquiring aircraft

MRO provider StandardAero from Dubai Aerospace. The expansion of

PE portfolios compliments firms’ understanding of future demands as

new generation aerospace technology is released.

14%

28%

47% 43%

19%

35%

20% 24%

13%

33% 38% 41%

51%

50%

33% 40%

43%

28%

51% 45%

47%

50%

49%

30%

35%

23% 19% 17%

38% 37%

29% 30%

41%

17% 14%

30%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Q1'14 Q2'14 Q3'14 Q4'14 Q1'15Q2'15

Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15

Finance Public Private