3

Second Quarter 2015

Company

Strategic Actions

Sector

Value /

Size

Acquired

Blackbird

Cybersecurity / A&D $420M EV

Acquired

Websense

Cybersecurity

$1.7B EV

Will Divest

IC Solutions Div.

Gov. Services & IT

$1.7B Rev

Will Retain

Applied Intell.

Cybersecurity

NA

Reinvesting in

Land Systems

A&D

NA

Will Acquire

Sikorsky

A&D

$9.0B EV

Will Divest

IS&GS

Gov. Services & IT

$6B Rev

Will Divest

Commercial Cyber

Commercial Cyber

NA

Will Retain

Gov. Cybersecurity Gov. Cybersecurity

NA

Divested

QinetiQ N.A.

Gov. Services & IT

$780M Rev

Retained

Cyveillance

Cybersecurity

$20M Rev

Acquired

STG

Gov. Cybersecurity

$166M EV

Acquired

KSG

Cybersecurity

NA

Divested

MCSI

Commercial Cyber

NA

Divested

Fidelis

Commercial Cyber

NA

Acquired

Exelis

A&D

$4.7B

Acquired

LTC Engineering

Cybersecurity

$16M

Split

Dividing into US Public Sector and Global Commercial

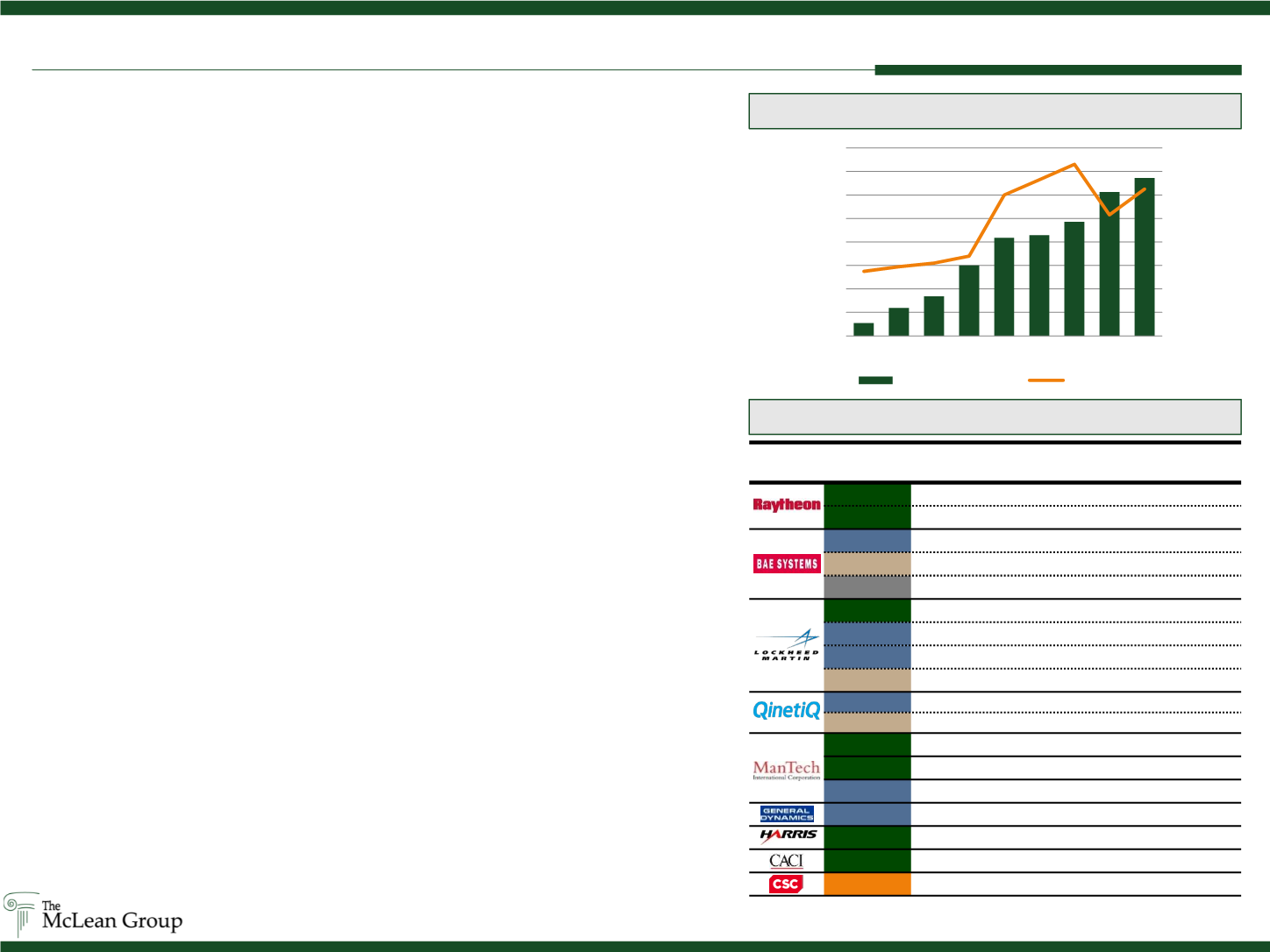

Cyber Security and IT M&A Trends

Source: OMB Annual Reports to Congress: FISMA

1

, OPM Office of Communicaitons

2

; S&P Capital IQ; DACIS, Wired

Large Prime Contractor Portfolio Restructuring

$0

$2

$4

$6

$8

$10

$12

$14

$16

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

2006 2007 2008 2009 2010 2011 2012 2013 2014

FISMA Spending (Billions)

Number of Incidents (Thousands)

Reported Incidents

FISMA Spending

Reported FISMA Security Incidents and Spending

2

In May the Office of Personnel Management (OPM) announced that it was hacked by foreign

agents, exposing the personal information of more than 21 million federal employee and

applicant files.

1

This is only the latest of many recent federal data breaches – NSA, IRS,

USPS, Healthcare.gov – and further highlights government IT infrastructure vulnerabilities as

the number of reported cyber security incidents climb.

2

Consequently, IT and cybersecurity

modernization is a rapidly growing federal priority. Agencies hope not only to modernize the

systems, but also cut costs, especially in traditional IT services. Cost savings are expected to

free up funds for specialized services such as cybersecurity and advanced analytics.

Additional strategic priority shifts are driven by the Defense Department’s light footprint

strategy which relies heavily on superior defense and communications systems. The new

strategy’s technical demands are motivating contractors to realign core capabilities focusing

on these systems’ requirements which will provide greater long-term growth and margins.

M&A activity shows large prime contractors already executing on this strategy, building

capabilities in cyber and defense systems while exiting the more traditional IT and

professional services. The largest acquisition representing this trend is Harris Corp’s

purchase of Exelis for $4.7 billion. Completed in May, Exelis provides Harris with significant

synergy opportunities, especially across C4ISR. Raytheon’s purchases of Blackbird

Technologies for $420 million and Websense for $1.7 billion exemplify a cyber security focus.

In April, BAE announced plans to divest large parts of its Intelligence Community services

business, using the proceeds to develop aerospace and defense products. BAE will retain its

cybersecurity arm and Systems Applied Intelligence. Shortly after Q2 close, Lockheed Martin

disclosed similar plans, announcing its intention to acquire Sikorsky for $9 billion while

exploring sale options for its Information Systems & Global Solutions (IS&GS) division, but

retaining its specialized cybersecurity capabilities.

Converse to Raytheon’s foray into commercial cyber with its purchase of Websense,

Lockheed intends to exit its commercial cyber position. A move proceeded by both General

Dynamics and ManTech which divested commercial cybersecurity positions in Q2. Despite

synergy potential, commercial and public sector cybersecurity capabilities prove difficult to

integrate, causing contractors to refine focus on public sector cyber. Both ManTech and

CACI demonstrated this in Q2 with public sector cybersecurity acquisitions. Also indicative of

this challenge is CSC’s announced split which will result in two publicly traded companies,

one focused on Global Commercial customers and the other on the US Public Sector.

Going forward prime contractors will likely focus on further refining portfolios to stay ahead of

specific government technology and cyber security modernization and acquisition priorities.

Further divestitures are expected along with targeted mid-market acquisitions of small, high

margin companies offering specialized services and capabilities.