4

Second Quarter 2015

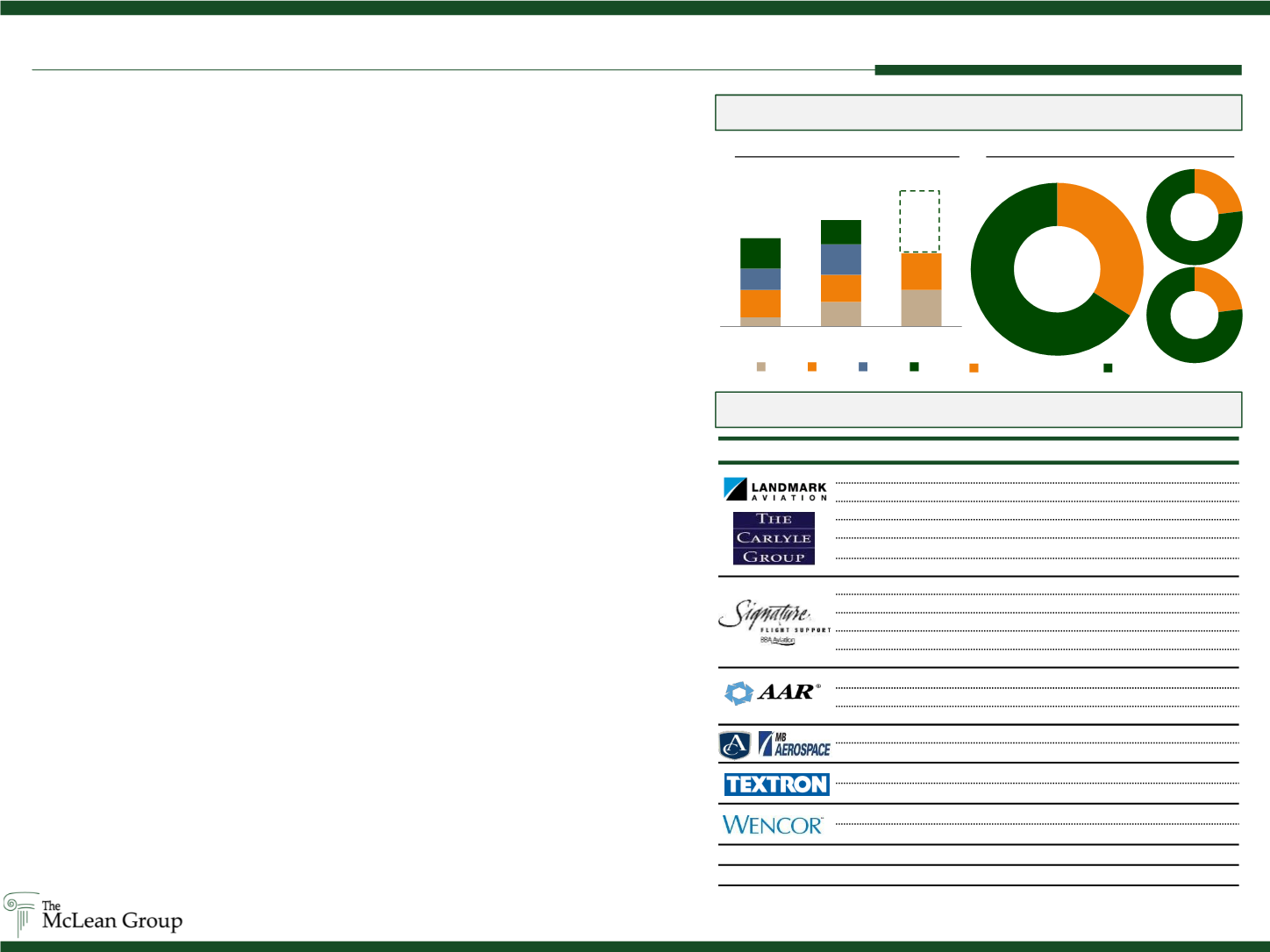

Global airline traffic grew 6% in 2014 (the fourth consecutive year above 5%),

and is projected to grow another 35-40% over the next decade.

1

Increased air

traffic, evolving next generation aircraft requirements and an expanding business

jet fleet are creating opportunities for Maintenance, Repair and Overhaul (MRO),

Ground Support Equipment (GSE) and Fixed Base Operations (FBO)

businesses. Consequently, MRO and FBO companies are the largest Aerospace

M&A categories based on transaction volume, representing nearly a quarter of all

TMG tracked aerospace deals in 2013 and 2014, and already more than a third

of 2015 transactions.

As the unprecedented commercial aircraft backlog continues to drive strong

valuations for quality supply chain businesses, strategic investors often have had

an advantage. Accordingly, MRO, FBO and ground support services and

equipment may represent a more accessible entry point to an attractive market.

Furthermore, a level of fragmentation persists among companies serving these

areas and offers opportunity to build scale. Private equity groups that are building

platforms include The Carlyle Group with Landmark Aviation’s six FBO

acquisitions, Arlington Capital with MB Aerospace in MRO, and most recently

Veritas Capital with its platform acquisition of StandardAero, one of the world's

largest independent providers of aircraft MRO.

Meanwhile, strategic buyers are actively shaping portfolios to capitalize on

growing market demand for ground services and equipment. Signature Flight

Support acquired five FBO operations over the last two years. AAR is building out

its Aviation Services division with three acquisitions, while shedding Telair Cargo

and positioning to sell its Precision Systems Manufacturing operations. Wencor

expanded its international MRO position with two acquisitions that added

specialty capabilities in cargo and interior systems. Textron added to its

Specialized Vehicles division, acquiring two GSE companies that will complement

its existing brands E-Z-GO, Cushman and Bad Boy Buggies. In addition to MRO,

FBO and GSE, other growing areas of strategic M&A interest include software

and data analytics capabilities that capitalize on rapidly expanding data outputs to

maximize efficiency and drive operations and systems design.

Industry Trends

(Aerospace Ground Support Services M&A update)

Source:

1

“Aviation Week’s Top 10 Airframe MRO Providers”, S&P Capital IQ, Public filings

MRO, GSE and FBO Transaction Activity

3

8

12

9

9

12

7

10

10

8

2013

2014

2015

Q1 Q2 Q3 Q4

29

34%

66%

2015 YTD

MRO, GSE & FBO Other Aero

23

%

77

%

2013

Buyer

Target

EV Announced

ERA FBO, LLC

NA

4/8/2015

TWC Aviation, Inc.

NA

4/3/2015

Ellington & Southwest Airport Services

NA 2/19/2015

Island City Flying Service, Inc.

NA

2/4/2015

Atlantic Aero, Inc.

NA 6/30/2014

Ross Aviation, LLC

NA 4/23/2014

Wiggins Airways FBO assets

$16.2M 10/8/2014

FBO 2000 Antigua Limited

$5.6M

8/5/2014

Landmark Aviation Scottsdale AirCenter

$55.8M

8/4/2014

Maguire Aviation

$69.0M 8/27/2013

Starlink Aviation Inc., FBO Montreal

$4.0M 6/26/2013

Cool Containers, LLC

NA 8/27/2014

Sabena Technics Brussels

NA 3/20/2014

PFW Aerospace, Cargo Loading System

NA 12/2/2013

Norbert Industries

NA

4/1/2014

Delta Industries

NA

6/2/2013

Douglas Equipment Limited

NA 1/13/2015

TUG Technologies Corp

NA

5/3/2014

PHS/MWA Aviation Services

NA

4/6/2015

XTRA Aerospace

NA

4/9/2014

LLCP / Tronair

Wasp, Inc., Commercial Towbar & Tailstand

NA 1/14/2015

Veritas Capital

Standard Aero

NA 5/26/2015

35

?

Total Subsector Transactions As a % of Total Aerospace M&A

23

%

77

%

2014

Notable Acquisitions and Consolidations