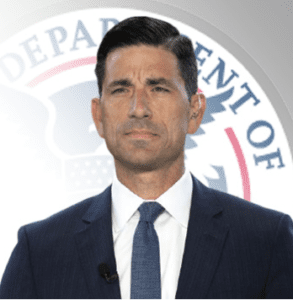

Announcing Chad Wolf as Featured Speaker for McLean’s 2021 M&A and Valuation Summit

MCLEAN, VA – The McLean Group is pleased to announce that former Acting Secretary of the U.S. Department of Homeland Security Chad Wolf will be our featured speaker for the “Investment Opportunities in Critical Infrastructure” discussion we will be hosting as part of our Spring M&A and Valuation Summit. Currently, Mr. Wolf is the Founder and President of Wolf Global Advisors, a strategic advisory and public policy firm helping private companies, government agencies, and non-governmental organizations address domestic and international security and risk challenges.

MCLEAN, VA – The McLean Group is pleased to announce that former Acting Secretary of the U.S. Department of Homeland Security Chad Wolf will be our featured speaker for the “Investment Opportunities in Critical Infrastructure” discussion we will be hosting as part of our Spring M&A and Valuation Summit. Currently, Mr. Wolf is the Founder and President of Wolf Global Advisors, a strategic advisory and public policy firm helping private companies, government agencies, and non-governmental organizations address domestic and international security and risk challenges.

About Chad Wolf

Mr. Wolf served at The Department of Homeland Security under both President George W. Bush and President Donald J. Trump. He held numerous senior level positions including Assistant Administrator for The Transportation Security, Assistant Secretary, Chief of Staff, and was the first Senate-confirmed Under Secretary for Policy. From November of 2019 to January of 2021 Wolf served as the Acting Secretary where he oversaw an annual budget of approximately $47 billion, managed over 240,000 employees in 22 operating components and agencies to include the fifth branch of the Armed Services – the U.S. Coast Guard.

Wolf is a nationally recognized expert in counterterrorism, law enforcement, border security, immigration, emergency management, critical infrastructure, and economic security. During his time at DHS, he successfully navigated numerous global and domestic challenges to the nation’s security – including COVID 19, civil unrest, numerous border and immigration crises, historic natural disasters and threats to global aviation security.

About The Summit

In addition to Chad Wolf, the McLean Group’s 2021 Virtual M&A and Valuation Summit will feature a keynote address by General David Petraeus, Former Director of the Central Intelligence Agency and current Partner at KKR & Co. This half day event will also be highlighted by six-panel discussions with 30+ C-level speakers from some of the most recognizable brands in Defense, Government & Intelligence (DGI), Security, and Critical Infrastructure. .

Learn more about this conference and register for this free event click here. Note that registrations are reserved for industry CXOs, government, and investment professionals and subject to firm approval based on availability.

About The McLean Group

For over 30 years, The McLean Group has been providing investment banking and financial services offerings focused on the Defense, Government & Intelligence (DGI), Security, Critical Infrastructure, Maritime, Facility Services, Unmanned Systems, and Public Safety markets. Our 60+ professionals bring deep industry experience and relentless execution to every client engagement. We provide solutions that blend financial creativity with operational expertise. Whether we are providing transaction advisory, valuation opinions, or growth capital, our services are unmatched in these core markets. Learn more at www.McLeanLLC.com.

RECENT NEWS

Fairness Opinions: Protecting Boards and Shareholders in M&A

As we approach the end of the year, many companies are finalizing strategic decisions, closing transactions, and preparing for what’s ahead. For directors and executives, this often means heightened scrutiny around governance and shareholder protection. Beyond negotiating terms and aligning on strategy, boards must also demonstrate that they acted in the best interests of shareholders. One tool has become increasingly important in this process: the fairness opinion. […]

Monthly Middle Market M&A Insider Report (August 2025)

The McLean Group’s August 2025 M&A Insider Report highlights a month of dynamic transaction activity across defense, government, technology, and infrastructure sectors. Notable deals include acquisitions in ISR software, EO/IR satellite payloads, offensive cyber, aerospace components, and laser systems — underscoring strong buyer demand for mission-critical technologies and advanced manufacturing. Valuation multiples remain robust, driven by continued interest from strategic and financial sponsors seeking growth in high-priority national security and infrastructure markets. This report provides executives with a clear view of how current deal flow, sector dynamics, and valuation trends are shaping opportunities for both acquirers and sellers. […]

McLean advised South Central Water Company in its transaction with H2O America

The McLean Group advised South Central Water Company on the divestiture of its Cibolo Valley wastewater treatment plant and related assets to H2O America’s Texas Water Company. The transaction will expand TWC’s footprint in the Texas Hill Country by adding over 1,500 new wastewater connections, with more than 250 additional connections under contract. This acquisition strengthens TWC’s service area and provides customers with increased efficiency and enhanced customer experience solutions. […]